Introduction:

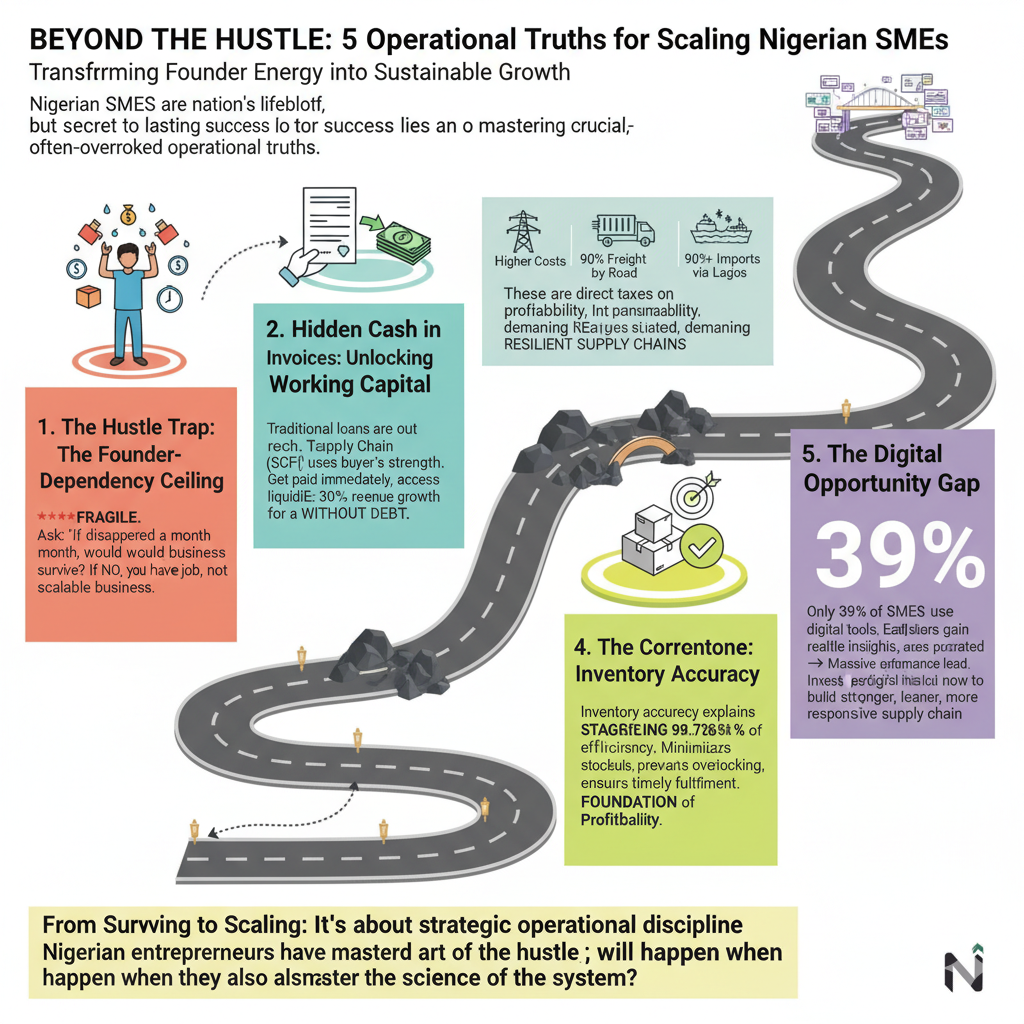

Beyond the Hustle

Nigeria’s economy

pulses with the energy of its entrepreneurs. Small and Medium-sized Enterprises

(SMEs) are the lifeblood of the nation, making up nearly all businesses in the

country and providing the majority of jobs. From the tech hubs of Lagos to the

bustling markets of Kano, there is no shortage of creativity, ambition, and an

endless supply of "hustle."

Yet, despite this

vibrant entrepreneurial spirit, a frustrating reality persists: most of these

businesses fail to scale. They thrive on the founder's energy but remain

vulnerable to shocks, unable to achieve sustainable growth. The ambition is

there, but the foundation is often shaky.

The difference between a business that merely survives and one that truly succeeds often lies in a place most founders overlook. It’s not about working harder or having a more popular brand on Instagram. The secret is hidden in the operational backbone of the business, its supply chain. Mastering a few surprising, often-ignored truths about how a business actually runs is what separates fleeting hype from lasting success.

1. Your Business Is

Built on Hustle, Not Systems, And That's a Trap

The primary weakness

preventing Nigerian SMEs from scaling isn't a lack of market opportunity; it's

an absence of internal structure. In the race for visibility and revenue, a

critical flaw emerges: Hype often outweighs systems. This leads to

businesses that are entirely dependent on the founder's daily firefighting and

micromanagement, making them incredibly fragile.

Many businesses look

successful from the outside but are internally chaotic. Operations depend on

the founder's memory, personal relationships, and constant intervention. When

the founder is present, things move. When they're not, the entire operation

grinds to a halt. This founder-dependency is a ceiling on growth.

A fashion

entrepreneur, whose brand was a sensation on social media, captured this

vulnerability perfectly after a key employee's departure nearly collapsed her

business:

“The business looks

strong on the outside, but it all rests on me.”

Ask yourself the most critical question, and answer it honestly: 'If I disappeared for a month, would my business survive?' If the answer is no, you don't have a scalable business; you have a high-stakes job.

2. There's Hidden

Cash in Your Invoices, And It's Not a Loan

For countless Nigerian

SMEs, a chronic lack of access to working capital is the single biggest barrier

to growth. Traditional bank loans are often out of reach, demanding extensive

collateral, lengthy application processes, and high interest rates that small

businesses cannot afford. This liquidity gap means SMEs can't buy raw

materials, fulfill large orders, or manage day-to-day costs, even when they are

profitable on paper.

A modern solution is

emerging to solve this crisis: Supply Chain Finance (SCF). In simple terms,

SCF allows an SME (the supplier) to get paid almost immediately for an invoice

sent to a large corporate buyer. Instead of waiting 60 or 90 days for payment,

a third-party financier pays the SME upfront. The large buyer then repays the

financier on the invoice's original due date.

This is the game-changing twist. In a traditional loan, the bank looks at your SME's limited credit history and sees risk. With SCF, the financier looks at your invoice to a large, credible company and sees a guaranteed payment. Your buyer's strength becomes your strength, unlocking cash without you having to prove a thing. It's a way to access liquidity without adding any debt to your balance sheet. For instance, one plastic packaging manufacturer in Lagos used a digital SCF platform and grew its revenue by over 30% in less than a year, all without taking on new debt.

3. The True Scale

of Nigeria's Infrastructure Gap Is Staggering

Every business owner

in Nigeria knows that infrastructure is a challenge. But while many have

adapted to the daily frustrations, few appreciate the true scale of the problem

and its direct, quantifiable impact on their bottom line. The actual numbers

are staggering.

- Power: Due to an inconsistent national grid, Nigerian businesses are

forced to rely on diesel generators. This makes their cost of power 3.8

times higher than it would be otherwise. This isn't an inconvenience;

it's a direct tax on your profitability, forcing you to choose between

pricing yourself out of the market or sacrificing your margins.

- Transportation: The logistics industry is almost entirely

uni-modal. Road haulage transports 90% of all freight in the

country, placing immense pressure on a road network that is often in poor

condition. This forces near-total reliance on roads, where poor conditions

lead to damaged goods, vehicle wear-and-tear, and unpredictable delivery

timelines that kill customer trust.

- Ports: The system is dangerously centralized. Over 90% of all goods

imported into Nigeria are brought through the ports in Lagos. This

means your inventory, and your cash is likely sitting idle for weeks, not

because of your planning, but because of a national bottleneck you must

strategically plan around.

These are not just inconveniences; they are fundamental operational hurdles that directly inflate costs, create unpredictable delays, and erode profit margins. A successful business strategy isn't about wishing these problems away; it's about building a supply chain resilient enough to navigate them.

4. One Simple

Metric Explains 98.7% of Your Warehouse Problems

Warehouse and supply

chain management can feel overwhelmingly complex, filled with dozens of

processes, technologies, and metrics. However, deep analysis reveals that one

key performance indicator (KPI) has a shockingly outsized impact on overall

success.

A detailed study of

warehouses in Edo State found that inventory accuracy plays the most

significant role, explaining a staggering 98.7% of the variation in

operational efficiency. This directly challenges the 'hustle' model. A

business that runs on the founder's memory cannot achieve high inventory

accuracy; it requires a disciplined system.

Why is this one metric

so powerful? Because high inventory accuracy is the foundation of a reliable

and cost-effective operation. When you know exactly what you have and where it

is, you:

- Minimize stockouts, preventing lost sales and frustrated

customers.

- Prevent overstocking, which ties up precious cash in unsold

goods.

- Ensure timely and accurate order

fulfillment, which is a

critical factor for customer satisfaction.

For any business that holds stock, an obsessive focus on improving inventory accuracy isn't just one of many priorities, it is the cornerstone of operational excellence and profitability.

5. Most Businesses

Aren't Digital, Creating a Massive Opportunity Gap

Despite the global

push towards digitization, the adoption of digital technology for supply chain

management among Nigerian SMEs remains surprisingly low. A study of

manufacturing enterprises in Southwestern Nigeria found that only 39% had

adopted digital tools for their supply chain operations.

This slow adoption

isn't just about mindset; it's compounded by the infrastructure realities

discussed earlier. With unreliable power, the barrier to entry for 'always-on'

digital systems is understandably high, yet overcoming it is where the

competitive advantage lies. The research confirmed a significant and positive

relationship between digital technology adoption and supply chain performance,

creating a massive "performance chasm" between the few who have

embraced technology and the majority who have not.

This means while your

competitors are still tracking inventory in spreadsheets and confirming orders

via WhatsApp, a digital-first business has real-time stock levels, automated

reorder points, and a clear view of their entire operational pipeline.

For ambitious entrepreneurs, this gap represents a time-sensitive opportunity. By investing in digital tools now, from inventory management software to transportation management systems, early adopters can build a stronger, leaner, and more responsive supply chain before the rest of the market is forced to catch up.

Conclusion: From

Surviving to Scaling

The path from survival

to scale for a Nigerian business is paved with strategic, operational

discipline. The energy of the hustle can only take you so far. True,

sustainable growth requires a deeper understanding of the systems that power

your business.

To succeed, you must

move from founder-dependent hustle to robust systems that can run on their own.

You must unlock hidden cash with innovative finance, build resilience to

navigate infrastructure realities, focus on core metrics like inventory

accuracy, and seize the digital opportunity before it becomes standard

practice. These aren't just business tips; they are the fundamental truths that

will define the next generation of Nigerian success stories.

Nigerian entrepreneurs

have mastered the art of the hustle; what will happen when they also master the

science of the system?