The unprecedented disruption in the Red Sea has sent shockwaves through global commerce, forcing an urgent re-evaluation of supply chain resilience. Compounded by severe drought in the Panama Canal and the ongoing war in Ukraine affecting the Black Sea, this crisis highlights an "exceptionally challenging operating landscape." As of early 2024, an estimated 40% of Asia-Europe cargo has been rerouted via the Cape of Good Hope, adding an average of 10-14 days to transit times and significantly escalating operational costs. This ongoing crisis, sparked by Houthi attacks on commercial vessels in the Bab al-Mandab Strait, directly challenges the Suez Canal's historic role as the vital artery connecting East and West. The implications stretch far beyond shipping schedules, threatening to unravel carefully constructed logistics networks and trigger broader economic volatility.

The Immediate Fallout: Navigating the Storm

The initial response to the Red Sea crisis has been a scramble to adapt, manifesting in critical and immediate disruptions:

Shipping Delays & Rerouting: Vessels avoiding the Red Sea are forced into the longer, more fuel-intensive journey around Africa. This rerouting adds at least a week to shipping times and can delay docking by 20-30 days. For instance, a journey from Saudi Arabia's Ras Tanura to Rotterdam via the Cape of Good Hope is 5,754 nautical miles longer, increasing travel distance by 42% compared to using the Suez Canal. By February 2024, approximately 586 to 621 container ships had been rerouted through the Cape of Good Hope, leading to an 82% drop in container tonnage crossing the Suez Canal. This has also strained alternative routes, with the Panama Canal reducing daily transits from 38 to 24, and further to 18 per day by February 2024, due to extreme drought. As of October 2024, over 6,600 ships had been rerouted amid Red Sea tensions, resulting in a 66% year-on-year drop in Suez Canal transits, while Cape route traffic increased by approximately 57%.

Container Shortages: The longer voyages mean containers are tied up on ships for extended periods, exacerbating existing shortages in key Asian export hubs. This scarcity drives up spot rates and creates bottlenecks for exporters.

Soaring Shipping Costs: Shipping container prices have skyrocketed, especially between China and Europe. UNCTAD reported a 256% increase in rates from Shanghai to Europe, with rates to the US West Coast also increasing by 162%. The Shanghai Containerised Freight Index (SCFI) showed the cost of shipping a 20-foot container rising from about $851 to $1,497 in mid-December 2023, closing 2023 at $2,694, and further increasing to $4,500 in 2024. As of July 11, 2024, the Drewry World Container Index (WCI) rose from $2,725 in May 2024 to $5,900 for 40-foot containers, an almost 300% increase compared to July 2023. Rerouting a ship to Rotterdam adds between $500,000 and $1,000,000 to the journey cost, which is passed on to customers. Container vessels face an additional fuel cost of approximately $1 million per voyage via the Cape of Good Hope.

Spiraling Insurance Premiums & Surcharges: War risk insurance premiums for ships transiting the Red Sea rose from 0.07% of the ship's value in early December 2023 to between 0.5% and 0.7%, with some reports indicating premiums rising to 0.7% to 1% by early February 2024. Shipping companies are adding surcharges such as "Red Sea surcharge," "contingency surcharge," and "war risk surcharges."

Capacity Issues and Port Congestion: The rerouting of ships is causing capacity problems, exacerbated by Panama Canal restrictions. Delays limit port capacity, and port congestion can worsen shipping delays. Singapore's container port, the world's second-largest, is experiencing its worst congestion since the pandemic, with vessels waiting up to a week for berthing, delaying 380,000 TEUs. This congestion is spreading to neighboring ports like Malaysia. Despite a 10% expected increase in nominal shipping capacity in 2024, effective capacity has decreased by 11% due to congestion, route issues, and other concerns.

Schedule Reliability Decline: Global on-time performance for carriers dropped to 51.6% in January 2024, the lowest level since September 2022, primarily due to Red Sea diversions, impacting Asia-Europe and Asia-US East Coast routes and creating knock-on effects elsewhere.

The Domino Effect: From Ports to Pockets

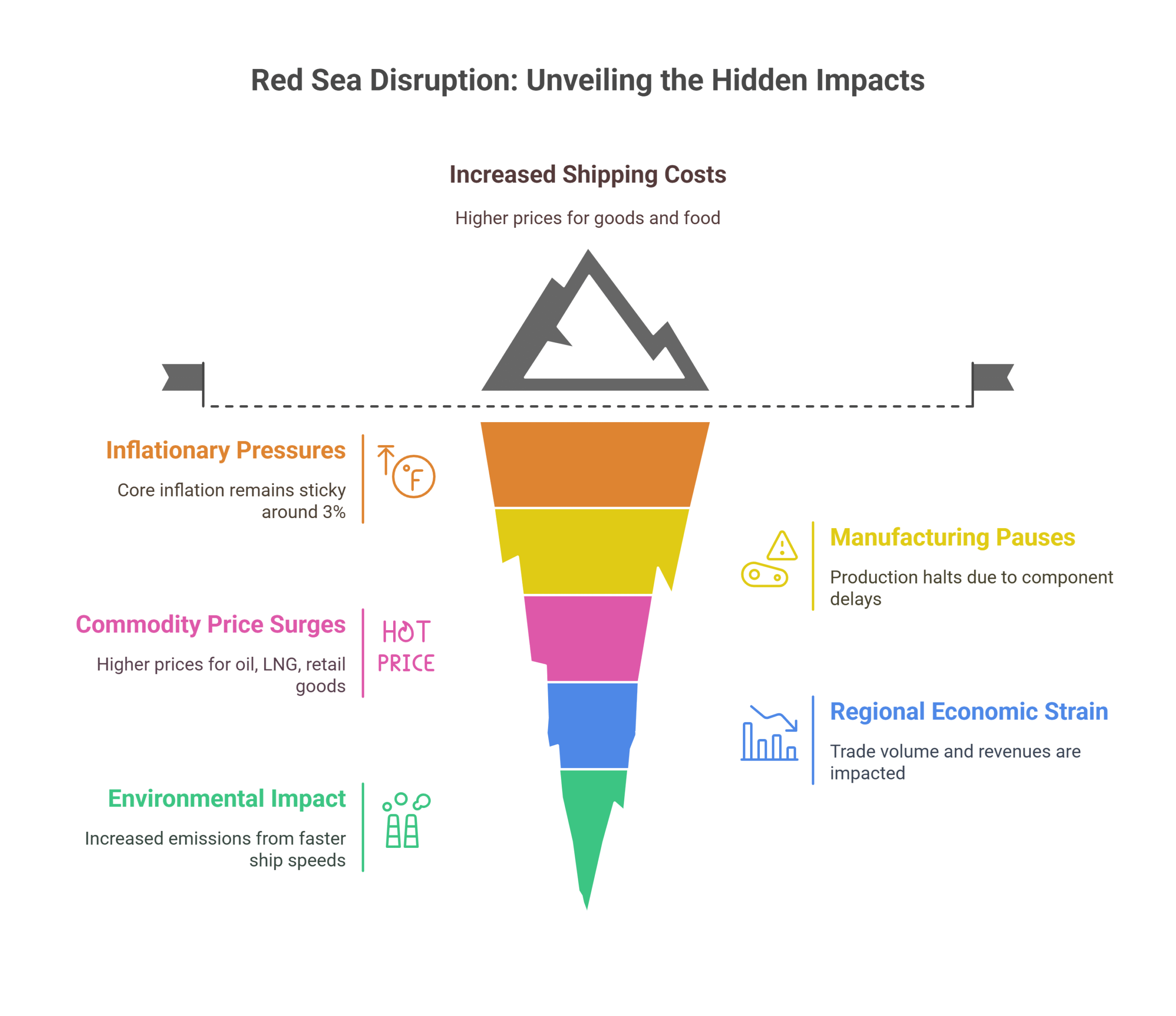

The immediate disruptions are merely the tip of the iceberg. The prolonged crisis is generating significant secondary effects that threaten economic stability:

Inflationary Pressures on Goods and Food Prices: J.P. Morgan Research estimates that if high container shipping costs persist, the disruptions could add 0.7 percentage points to global core goods inflation and 0.3 percentage points to overall core inflation during the first half of 2024, potentially keeping global core CPI inflation sticky around the 3% mark. The crisis also impacts global food prices, as longer distances and higher freight rates lead to increased costs; UNCTAD estimated about half of the food price increase in 2022 was due to higher transport costs.

Manufacturing Pauses: Industries relying on just-in-time inventory are feeling the pinch. Auto manufacturers like Tesla and Volvo have reported temporary production halts in European factories due to delays in receiving critical components from Asia. The new-energy vehicle (NEV) sector, a key part of China-Europe trade, is particularly affected.

Commodity Price Surges:

Oil and LNG: While direct impacts on oil prices have been volatile, the rerouting of LNG tankers from Qatar to Europe has led to longer voyages and higher shipping costs, potentially impacting energy prices.

Retail Goods: The increased cost of shipping, combined with delays, is inevitably translating into higher prices for consumers across a range of imported goods, from electronics to apparel. S&P Global Market Intelligence reports indicate a growing concern among retailers about absorbing these added costs.

Regional Economic Strain: East African countries such as Djibouti (31% of foreign trade by volume) and Sudan (34% of trade volume) are highly dependent on the Suez Canal. Egypt's Suez Canal revenues have reportedly dropped by 40%, a significant blow as it contributed $9.4 billion (2.3% of its GDP) in the previous fiscal year. The US, as the largest client of the Panama Canal (72% of its cargo volume), and countries on the West Coast of South America are significantly affected by the drought-induced restrictions, leading to a surge in demand for rail transport services in the US.

Environmental Impact: To compensate for longer routes and maintain schedules, ship operators have increased vessel sailing speeds. This leads to higher fuel consumption and increased greenhouse gas (GHG) emissions. A 1% speed increase typically results in a 2.2% rise in fuel consumption for a large container ship. A round trip from Singapore to Northern Europe via the Cape of Good Hope would see GHG emissions rise by over 70% per trip, potentially eroding environmental gains from "slow steaming" policies..

Long-Term Adaptations: Reshaping Global Logistics

The Red Sea crisis is serving as a stark reminder of supply chain vulnerabilities, accelerating pre-existing trends and forcing strategic shifts:

Strategic Inventory Management (Just-in-Case): Companies are prioritizing preparedness by shifting from "Just-in-Time" (JIT) to "Just-in-Case" (JIC) strategies. This involves holding more inventory than normal, including increased safety stock levels, to mitigate disruptions. Implementing inventory buffers (safety stock, capacity buffers, time buffers by ordering earlier) is crucial.

Supply Chain Digitalization and Advanced Technology Adoption: Digitalizing the supply chain allows for greater visibility and real-time tracking of inventory. This includes leveraging IoT technologies (sensors, GPS, RFID tags, QR codes, barcodes) for monitoring, implementing AI-enabled inventory optimization software for improved forecast accuracy and data-informed decisions, and exploring Blockchain technology for enhanced security and traceability.

Diversification of Suppliers and Locations (Reshoring, Nearshoring, Multishoring): Developing relationships with backup suppliers in different geographical areas creates redundancy. Companies are exploring reshoring (within the same country), nearshoring (within the same region), and multishoring (a portfolio of suppliers for the same items in various global locations) to balance risk.

Warehouse Automation and Multi-Warehousing: To accommodate increased inventory, warehouses are adopting automated solutions like Automated Storage and Retrieval Systems (ASRS), co-bots, and Autonomous Mobile Robots (AMRs) to maximize space. A multi-warehousing approach spreads inventory across multiple locations, creating redundancy and allowing inventory to be closer to customers (e.g., leveraging existing retail locations as micro-distribution centers or partnering with 3PLs).

Formal Supply Chain Risk Management: Moving beyond reactive "fire-fighting," a formal approach involves ongoing, preemptive identification, evaluation, planning, monitoring, and handling of adverse events. This includes developing specific strategies for identified risks (accepting, avoiding, reducing, hedging) and establishing clear protocols for quick-response teams and contingency plans.;

What This Means for You: Actionable Insights for Leaders

This crisis demands proactive measures across various executive functions:

For Logistics Managers: Prioritize contracts with shipping lines that offer flexible rerouting options. Explore and build relationships with air and rail freight providers for contingency planning. Implement robust real-time shipment tracking systems and utilize inventory optimization software to plan optimal order splits across different delivery routes.

For CFOs: Model at least three distinct scenarios for Q2 and Q3 cost overruns based on differing levels of Red Sea volatility. Factor in increased working capital requirements due to longer inventory transit times. Be prepared to adjust pricing strategies and communicate transparently with customers if increased costs need to be passed on.

For Supply Chain Directors: Conduct a comprehensive vulnerability audit of your entire supply chain, identifying single points of failure. Actively pursue diversification strategies for sourcing, manufacturing, and logistics. Embrace a "just-in-case" inventory mindset and champion digitalization efforts.

Case Study: Adapting to the New Reality of Global Supply Chain Disruptions

The current global logistics landscape, marked by the Red Sea crisis, Panama Canal drought, and the war in Ukraine, has led to significant time extensions (at least a week, up to 20-30 days for docking) and cost escalations. For instance, rates from Shanghai to Europe more than tripled (256% increase), and a single rerouted journey can add $500,000-$1,000,000 to costs. This has collectively reduced effective global container shipping capacity by approximately 9%. Businesses and supply chain stakeholders have implemented various strategies:

Short-Term Operational Adjustments: Companies are prioritizing orders, enhancing communication with suppliers and customers, and strategically reviewing transport methods. There's a notable growth in sea-air freight volumes (e.g., Dubai-Europe tonnages growing by 71% year-on-year in Q1 2024) and increased demand for rail transport as "land bridge" alternatives.

Long-Term Supply Chain Resilience Strategies: This includes the broad shift to "Just-in-Case" inventory, investment in warehouse automation (ASRS, co-bots, AMRs) and multi-warehousing, and emphasizing real-time inventory visibility through digitalization and IoT. Advanced inventory forecasting, supplier diversification (reshoring, nearshoring, multishoring), and formal risk management processes are also critical. Shipping companies like CMA CGM have selectively resumed Red Sea transits, and new intra-Red Sea feeder services (e.g., Folk Maritime) have emerged.

Despite these adaptations, challenges persist, including declining schedule reliability (51.6% on-time performance in January 2024), sustained high shipping costs contributing to inflation, and persistent port congestion (Singapore experiencing its worst since the pandemic). The World Trade Organization (WTO) chief economist noted that while freight rates have risen, they are not nearly as high as their peak during the COVID-19 pandemic, suggesting industry adaptability. However, specific sectors like the automotive industry continue to face significant tests of their supply chain resilience.

Conclusion: Preparing for Protracted Volatility

The Red Sea crisis, which began after Nov 2023 Houthi attacks, is not a temporary blip but a catalyst for fundamental shifts. Diversion is expected through mid-2025. Expect a period of 6–12 months of sustained volatility in freight rates and shipping schedules, driven by overlapping disruptions, persistent congestion, and underlying strong demand. Companies that merely react will face significant competitive disadvantages. The organizations that thrive will be those that embrace strategic agility, invest in resilient supply chain designs, and prioritize transparency.

The time to act is now. Don't wait for the next disruption to expose your vulnerabilities. Audit your supply chain vulnerabilities today to build a more resilient future.

References

Bloomberg. (2024) Shipping Costs Surge Amid Red Sea Disruptions. Available at: www.bloomberg.com

Boston Consulting Group (BCG). (2024) Reshoring and Nearshoring Trends in Global Supply Chains.

Clarksons Research. (2024) Red Sea Shipping Disruptions Report. Drewry. (2024) World Container Index.

Gartner. (2024) Supply Chain Digitalization Trends. Harvard Business Review. (2024) Building Resilient Supply Chains.

International Maritime Organization (IMO). (2024) Emissions Impact of Rerouted

Shipping. International Monetary Fund (IMF). (2024) Global Trade Disruptions Report.

J.P. Morgan Research. (2024) Inflation Risks from Shipping Disruptions.

Lloyd’s of London. (2024) War Risk Insurance Premiums.

Maersk. (2024) Red Sea Rerouting Cost Analysis.

Maritime Executive. (2024) Impact of Cape of Good Hope Diversions.

McKinsey & Company. (2024) Just-in-Case Inventory Strategies.

Panama Canal Authority. (2024) Drought Impact on Canal Operations.

PSA International. (2024) Singapore Port Congestion Updates.

Reuters. (2024) Tesla and Volvo Production Halts.

Suez Canal Authority. (2024) Traffic Decline Reports.

UNCTAD. (2024) Global Trade and Shipping Disruptions.

World Shipping Council. (2024) Container Shortage Crisis.