Introduction: A

Turning Point for Fuel Distribution

Nigeria’s petroleum distribution has long suffered from vandalized pipelines, poor roads, and logistical inefficiencies. With 80% of fuel moved by road, the system has become costly and unreliable. But a major shift is coming: Dangote Refinery is deploying 4,000 Compressed Natural Gas (CNG) trucks, starting August 15, 2025. This move could transform Nigeria’s downstream sector by tackling fuel scarcity and inefficiencies at the root.

The Dangote CNG

Truck Rollout: What’s New?

The new fleet features

GPS-enabled, CNG-powered trucks designed for real-time tracking and

direct delivery. These trucks will transport PMS and diesel from the refinery

to various clients, marketers, telecoms, manufacturers, and aviation firms with

free logistics included.

Switching to CNG helps cut fuel costs, reduce emissions, and aligns with Nigeria’s clean energy goals. Dangote is also building over 100 CNG booster stations nationwide to support the network.

Solving Nigeria’s

Longstanding Fuel Distribution Problems

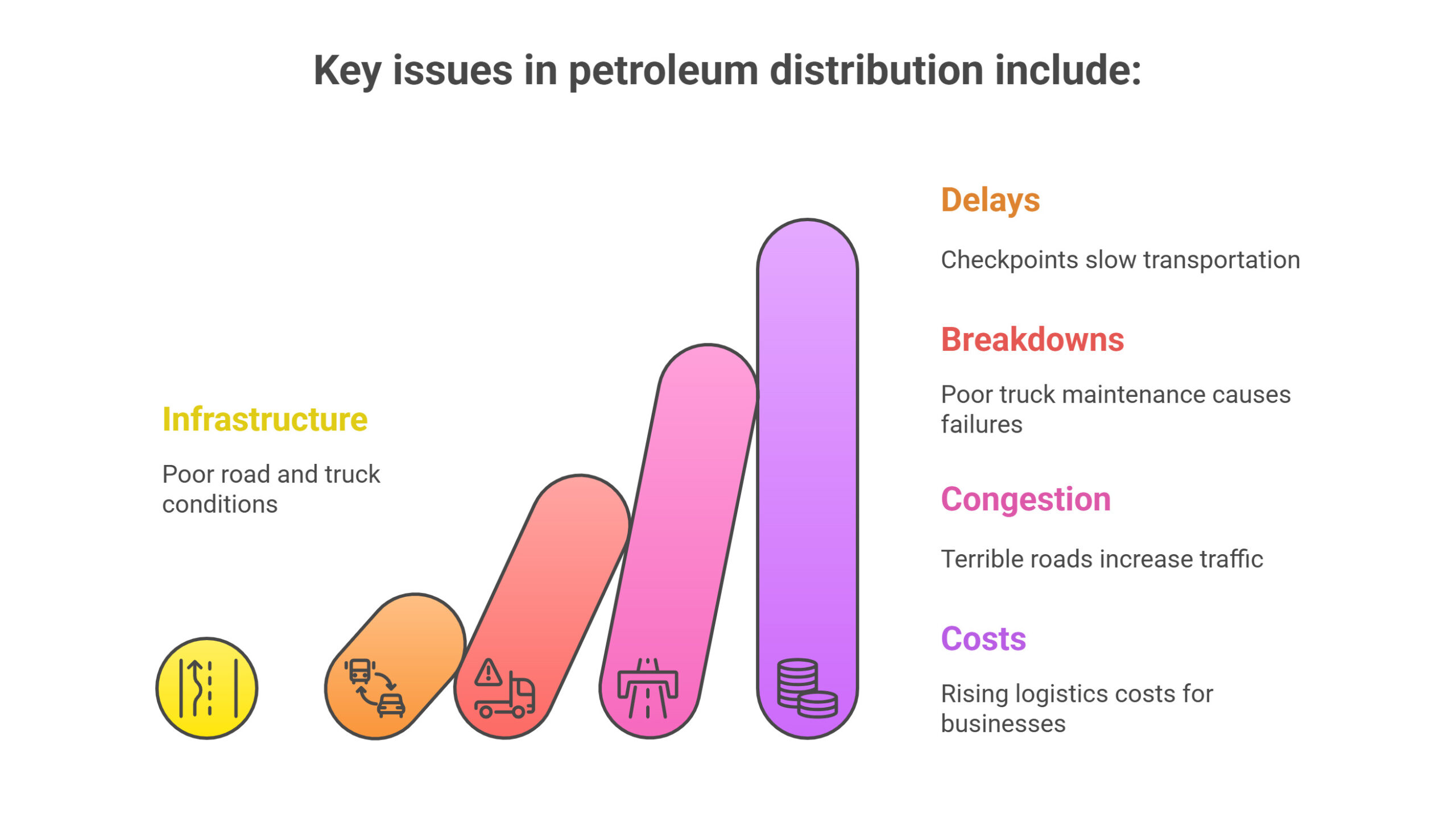

Key issues in

petroleum distribution include:

- Delays at checkpoints

- Mechanical breakdowns from poor truck

maintenance

- Terrible road conditions

- Traffic congestion and rising logistics costs

Dangote’s direct-distribution model bypasses fragile pipelines and intermediaries, cutting costs and boosting fuel access nationwide. Lower transport expenses could eventually stabilize or reduce pump prices while improving efficiency and safety.

A Supply Chain

Game-Changer

The initiative

directly supplies petroleum to retailers, manufacturers, and large users bypassing

depots. This decentralizes distribution, especially in underserved areas,

and may help revive inactive filling stations. Marketers benefit from reduced

logistics costs, which could reflect in consumer pricing.

It also addresses

frequent issues like tanker accidents, driver strikes, and northern supply

shortages by removing weak links in the chain.

Impact on

Competitors and the Transport Sector

Not everyone is

cheering. Tanker unions and oil marketers worry about job losses and

displacement. Groups like NARTO and NOGASA fear losing their roles as

middlemen. Talks of strikes and operational halts have surfaced.

Some analysts suggest

the initiative could create healthy competition or new partnerships, while

others warn of disruption, asset redundancy, and potential market dominance.

IPMAN seems ready to partner with Dangote out of economic necessity, but

PETROAN warns of a "Greek gift," fearing a future price surge if a

monopoly forms.

Regulatory bodies are urged to monitor market share closely and encourage the emergence of other refineries to avoid over-dependence on a single supplier.

Environmental and

Economic Benefits

- Cleaner transport: CNG reduces emissions, supporting

national climate goals.

- Cost savings: Lower logistics costs can ease inflation

and support SMEs.

- Job creation: While some tanker drivers may be

displaced, others could find work in the new supply chain or related

sectors.

- National development: Aligns with the government’s CNG

transition agenda under the “Renewed Hope” plan.

Risks and

Considerations

- Infrastructure readiness: Road conditions and CNG station coverage

could hinder operations.

- Safety standards: Success depends on training and proper

handling of CNG trucks.

- Market control: Without regulation, Dangote could gain

dominant market share, limiting competition.

- Sustainability concerns: Like previous monopolies in flour,

cement, and sugar, there are fears of eventual price hikes.

Conclusion: A New

Fuel Era

Dangote’s 4,000 CNG

trucks represent more than a logistics upgrade; they symbolize a major restructuring

of Nigeria’s petroleum supply chain. With free logistics, cleaner energy,

and direct delivery, the refinery challenges the old model and may reduce

consumer costs.

What’s next?

- Marketers must adapt or partner.

- Policymakers must prevent monopolies, improve

infrastructure, and support multiple players.

- Stakeholders must collaborate for a fair, competitive, and sustainable energy market.

This could be the bold

shift Nigeria needs, if managed wisely.