We’ve all done it in our personal lives. You buy the "budget" pair of boots for winter because they are half the price of the quality brand. Two weeks later, the sole peels off in a puddle, and your socks are soaked. You end up buying the expensive pair anyway.

In the end, trying to save money cost you more money.

In the world of business procurement, we call this the Total Cost of Ownership (TCO) trap. Yet, surprisingly, many businesses still make decisions based solely on the sticker price at the bottom of a quote.

If you want to move from "purchasing agent" to "strategic partner" within your organization, TCO is the single most important concept you need to master. Here is why the lowest price is rarely the best deal.

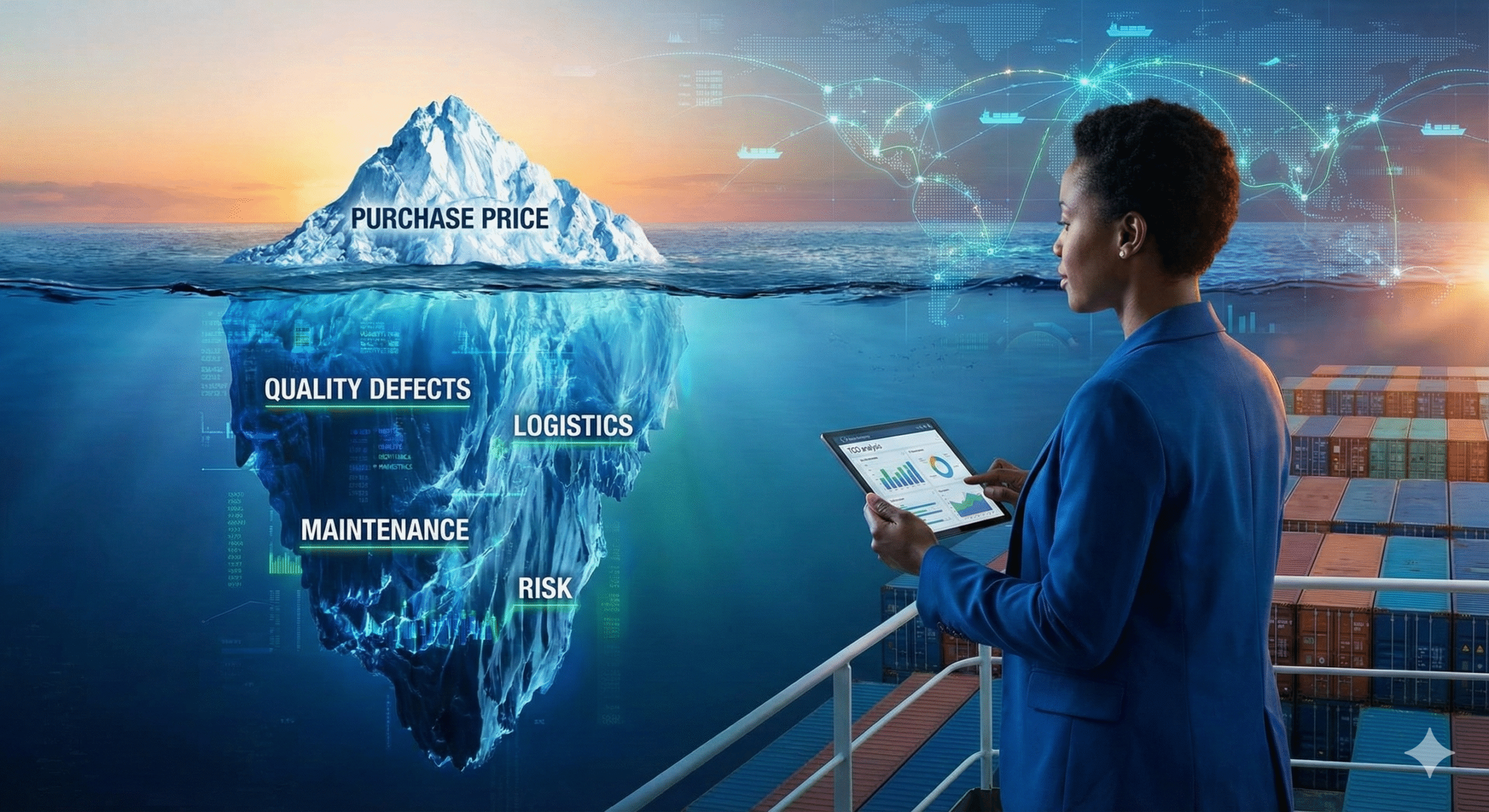

The Iceberg Illusion

Imagine you are sourcing a critical component for your manufacturing line.

Supplier A quotes $10.00 per unit.

Supplier B quotes $12.50 per unit.

On a spreadsheet, Supplier A looks like the hero. You save $2.50 per unit! If you buy 10,000 units, you just "saved" the company $25,000. You might even get a bonus.

But price is just the tip of the iceberg—the part you can see above the water. TCO is the massive chunk of ice below the surface that sinks ships.

Let's look at what happens when we calculate the actual cost of Supplier A.

The 5 Pillars of TCO (The Hidden Costs)

To calculate true value, you have to look beyond the invoice. Here are the five hidden costs that turn a "cheap" deal into an expensive mistake.

1. The Cost of Quality (Defects & Rework)

Supplier A is cheaper, but their defect rate is 3%, while Supplier B is 0.5%.

Every time a bad part hits your assembly line, the machine jams.

Production stops for 15 minutes.

A technician has to fix it.

You miss a shipment deadline.

Suddenly, that $2.50 savings is wiped out by one hour of downtime costing you $5,000. Cheap inputs often lead to expensive outputs.

2. The Cost of Logistics & Lead Time

Supplier A is in a different time zone with a 6-week lead time. Supplier B is local with a 3-day lead time. Because Supplier A takes so long, you have to stockpile inventory just in case. You are now paying for:

Warehouse space to store 6 weeks of stock.

Insurance on that stock.

Cash tied up in inventory that could be used for marketing or R&D.

3. The Cost of Maintenance & Service

When things go wrong—and they always do—who picks up the phone? Supplier B (the expensive one) might include 24/7 support and free replacement of faulty goods. Supplier A might have a "no returns" policy or ghost you when a shipment is lost. The administrative cost of chasing a bad supplier is a real, hard cost to your business.

4. The Cost of Risk

This is the big one. If Supplier A is the cheapest because they cut corners on safety or labor laws, you are buying a PR nightmare. Or, if they are your only source and they go bankrupt, your production line halts completely. Resilience has a price tag. Sometimes, paying a premium for a financially stable supplier is essentially an insurance policy.

How to Calculate Your TCO

You don't need complex software to start using TCO. You just need to ask the right questions before you sign a contract.

Create a simple scorecard for your major purchases that adds these "adders" to the purchase price:

Base Price: $10.00

Freight/Duties: +$1.50

Quality/Rework Estimate: +$0.75 (based on historical defect rates)

Inventory Holding Cost: +$0.50 (cost to store extra stock due to long lead times)

Admin/Management Cost: +$0.25 (extra time managing the vendor)

Real Cost of Supplier A: $13.00 Real Cost of Supplier B: $12.50

In this realistic scenario, the "expensive" supplier is actually $0.50 cheaper per unit when you factor in the friction of doing business.

The Bottom Line

Procurement isn't just about beating vendors down on price. It's about securing the best value for your business’s future.

When you present a decision to your CEO or CFO, don't just say, "I chose the cheapest option." Say, "I chose the option with the lowest Total Cost of Ownership, which reduces our risk and improves our production uptime."

That is the difference between a spender and a strategist.