I. The Unseen Backbone of Modern Civilization

Every time a missile strikes with precision, a farmer plants crops using GPS-guided tractors, or a financial transaction is timestamped, the invisible hand of satellite navigation is at work.

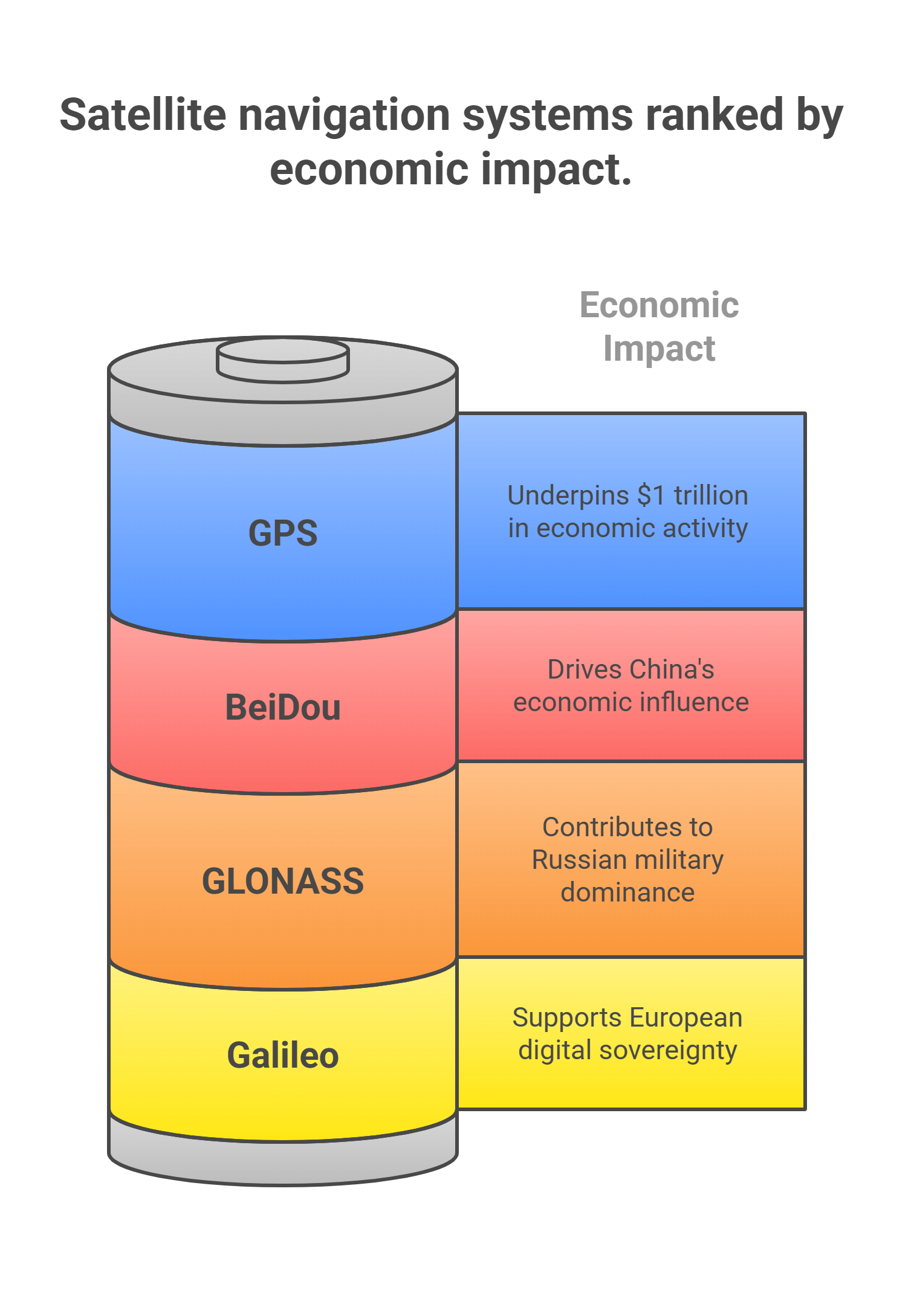

The U.S. Global Positioning System (GPS), initially a Cold War military tool, now underpins $1 trillion in annual economic activity—so critical that a single day’s disruption could cost the U.S. economy $1 billion (2019 study). Yet, GPS is no longer alone in orbit.

China’s BeiDou (BDS), Russia’s GLONASS, and Europe’s Galileo now compete in a high-stakes battle over digital sovereignty, military dominance, and economic influence.

For Africa—where logistics, agriculture, and telecom sectors are booming—this rivalry presents both opportunities and risks.

II. GPS vs. BeiDou: A Technical and Geopolitical Showdown

GPS: America’s Aging Titan

Origins: Born as a U.S. military asset, now indispensable for 6 billion global users.

Economic Impact: Powers missile guidance, aviation, finance, and ride-hailing—with disruptions potentially crippling supply chains.

Vulnerability: Experts warn GPS is "all too easy to disrupt or spoof", raising fears of Chinese cyberattacks in future conflicts.

Modernization Delays: Only 6 of 31 satellites are next-gen GPS III, with full upgrades delayed until 2032-2033.

BeiDou: China’s Strategic Masterstroke

Rise to Power: Launched in 2000 after China lost missile tracking in a Taiwan Straits crisis, BeiDou achieved global coverage by 2020—a feat in just 20 years.

Military & Diplomatic Tool: More than navigation, BeiDou is a "declaration of independence from the West", ensuring China can wage war without GPS dependency.

Global Reach:

1.1 billion users (2022), heavily concentrated in Africa, Asia, and South America.

45 satellites (30 advanced BDS-3 models)—more than GPS’s 31.

Ground stations installed worldwide, filling gaps where GPS infrastructure is weak.

Economic Engine: Projected to generate $156 billion for China by 2025, tied to Belt and Road infrastructure exports.

Killer Feature: Two-Way Messaging

Allows text communication without cell networks (critical for remote areas).

Raises surveillance concerns—could enable tracking of vehicles, shipments, or even dissidents.

III. The Geopolitical Chessboard: Why Africa is the Battleground

1. Digital Colonialism or Strategic Partnership?

China is subsidizing BeiDou adoption in Africa through BRI-linked ports, railways, and 5G networks.

Over 50 African nations now use BeiDou for transport, farming, and urban planning (UNOOSA, 2022).

Risk: Dependence on BeiDou could give China leverage over critical infrastructure.

2. The U.S. Counterplay: Can GPS Stay Relevant?

GPS III Upgrades: New satellites will offer:

8x anti-jamming power (60x in later models).

Enhanced signals for AI, drones, and self-driving cars.

But… BeiDou is already operational, while GPS modernization lags.

3. Africa’s Dilemma: Sovereignty vs. Convenience

Logistics startups (e.g., Nigeria’s Kobo360, Kenya’s Lori Systems) rely on GPS by default.

BeiDou’s edge: Superior accuracy in urban canyons and remote areas due to denser satellite coverage.

Smart Move: African firms must adopt multi-GNSS devices (GPS + BeiDou) to avoid geopolitical lock-in.

IV. The Future: A Fragmented or Interoperable World?

For Governments:

Diversify GNSS reliance—avoid over-dependence on one superpower’s system.

Regulate surveillance risks—BeiDou’s two-way messaging could enable unchecked tracking.

For Businesses:

The Bottom Line

The GPS-BeiDou rivalry is a proxy war for 21st-century influence. Africa must navigate carefully—embracing BeiDou’s benefits while safeguarding digital sovereignty. The continent’s logistics revolution will thrive only if it controls its own technological destiny.